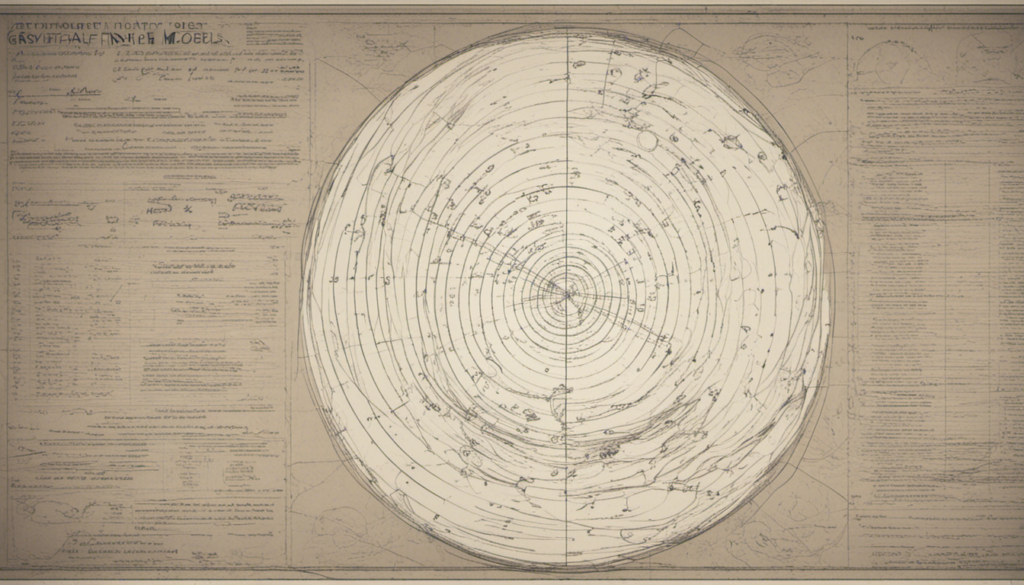

Using the Principles of Gravitation to Understand Financial Market Pulls, Shifts, and Cyclical Patterns

Introduction

Financial markets are complex systems influenced by various factors. Understanding the underlying principles behind their movements can provide valuable insights for investors and analysts. One such principle is the concept of gravitation, which can be applied metaphorically to financial market dynamics.

The Gravitational Pull of Market Forces

The financial market is like a celestial body, attracting and repelling various forces that affect its behavior. These forces can be categorized into internal and external factors.

Internal forces:

- Market sentiment

- Investor behavior

- Company fundamentals

- Industry trends

External forces:

- Macroeconomic indicators

- Geopolitical events

- Regulatory changes

- Technological advancements

Gravitational Shifts and Cyclical Patterns

Just like celestial bodies, financial markets experience gravitational shifts and cyclical patterns. These movements can be analyzed and predicted by observing historical data and identifying recurring trends.

1. The Pull of Market Cycles

Financial markets tend to follow cyclical patterns, characterized by periods of expansion, contraction, and consolidation. By understanding these cycles, investors can make better decisions regarding asset allocation and timing their investments.

| Phase | Description |

|---|---|

| Expansion | Rising prices, increased economic activity |

| Contraction | Falling prices, decreased economic activity |

| Consolidation | Stable prices, moderate economic growth |

2. Gravity of Investor Sentiment

Investor sentiment plays a significant role in shaping market movements. Positive sentiment can fuel bullish trends, while negative sentiment can lead to bearish trends. Understanding the psychology of market participants is essential for anticipating potential shifts.

3. Gravitational Waves of Economic Indicators

Macroeconomic indicators, such as GDP, inflation, and unemployment rates, act as gravitational waves that influence the direction and intensity of market movements. These indicators provide vital clues about the overall health of the economy and its impact on financial markets.

Example:

For instance, during periods of economic expansion, rising GDP and low unemployment rates create a positive gravitational pull on the stock market, leading to increased investor optimism.

Conclusion

Applying the principles of gravitation to financial markets can provide valuable insights into their pulls, shifts, and cyclical patterns. By understanding the internal and external forces influencing market behavior, investors and analysts can make more informed decisions. Remember, just as celestial bodies follow the laws of gravitation, financial markets too are subject to these principles.